Based on 843 users

rating

Based on 843 users

ratingCall or Text Now, Toll-Free

Redland Smart Debt Relief Provide You With The Best Medical Debt Relief in Redland, MD. We Offer Highly Professional staff For Medical Bill Debt Relief And Medical Debt Relief Programs Services.

Paying off medical debt is not as clear-cut as resolving other forms of debt, such as a loan or credit card. Medical debt affects people of all ages, and paying it off takes a different approach than Paying Off Credit Card or loan debt. Depending on your situation, you may be able to eliminate at least some of your medical debt without paying it. There is room for negotiation and a variety of payoff, forgiveness, and relief options that you can use to help manage your debt. If you are feeling overwhelmed by your bills, you can ask for the help of professionals of Redland Smart Debt Relief. The Medical Debt Relief Professionals at Redland Smart Debt Relief will help go through your billing, work with your medical provider, set up a budget, and come up with a personal plan for you.

Medical Bill Debt Relief in Redland, MD

A medical debt reduction plan can help you pay down your debts in less time, sometimes even reducing your balances with a settlement offer. At Redland Smart Debt Relief we can help you faster by offering the collectors a Medical Debt Settlement Agreement or plan for debt consolidation for medical bills. Redland Smart Debt Relief helps people like you get medical bill debt relief with debt settlement negotiation services and debt consolidation plans. You can visit us any day, any time to talk to our Team of Medical Debt Reduction pros today, and they’ll take the time to discuss your financial situation to come up with the solution that saves you the most money overall.

Medical Debt Relief Programs in Redland, MD

Medical debt is a kind of havoc on your financial well-being. Having medical debts added to your credit report hurts credit scores, making loans and insurance more expensive, along with limiting your housing options. Having Multiple Medical Debt Accounts on your credit report is a terrible situation because each one reduces your credit score even more. Redland Smart Debt Relief is a trustworthy place with a knowledgeable team and expertise to help you to get off medical debt with Debt Relief Counseling because medical debt on your credit report is a terrible situation because each one reduces your credit score even more. Medical debt relief programs at Redland Smart Debt Relief put an expert negotiator on your side to Settle Medical Debt with the greatest possible balance reduction, maximizing your medical debt relief. The team Redland Smart Debt Relief has experience dealing with all major medical debt collection agencies, so we know how to negotiate the best offers they’ll accept.

Covid-19 Medical Debt Relief in Redland, MD

If you have been hospitalized for Covid-19 and you find it hard to pay off medical bills, do not despair. There is a cure for Covid-19 and medical debt as well. A big number of people owe a medical debt and pay it back with their ease. Medical debt is handled differently than consumer debt. Medical Collection Accounts may have a lesser effect on credit scores than other types of collections accounts, though this isn’t guaranteed. Medical debt that was delinquent, charged-off, or sent to collection must be removed from credit reports once it is fully paid or settled. Thankfully, the Debt Relief Professionals at Redland Smart Debt Relief are equipped with a wealth of knowledge and experience. Our team is wholeheartedly committed to giving our clients industry-leading service that produces unmatched results.

Rip Medical Debt Relief in Redland, MD

RIP medical debt prevents millions from achieving financial stability and subjects them to emotional anguish. RIP medical debt was created to Relieve Medical Debt. At Redland Smart Debt Relief we work enthusiastically to produce a high volume of debt relief returns, mitigating significant financial and mental distress for millions of people. We have helped thousands of customers Achieve Financial Stability by settling their debts for less than what they owe, and we look forward to helping you as well. Our work brings attention to the range of negative impacts caused by medical debt and a deeper understanding of its causes.

Frequently Asked Questions

What is the biggest mistake people make when trying to pay off medical debt?

A big mistake is people ignoring their medical bills until they get sent to collections. It’s best to work out how you can pay your medical debt (or determine if you can’t pay your debt) before it gets to the point of going to collections.

What should be done to avoid medical debt?

Call your insurance company and research doctors who are in your network. You will need to understand how your insurance will work, including any copays or deductibles. Find a doctor within your budget who can treat you.

What happens if you don't pay the medical debt?

When a medical debt goes unpaid, the health care provider can assign it to a debt collection agency. In a worst-case scenario, you could be sued for unpaid medical bills. If you were to lose the case, a creditor or debt collector could then take action to levy your bank account or garnish your wages as payment.

Can medical debt be forgiven?

If you have outstanding medical bills that are past due, your creditors might be willing to agree to a debt settlement. This would allow you to pay less than what's owed to satisfy the debt, with the remainder forgiven. You can negotiate a debt settlement on your own or hire a debt settlement company to do so on your behalf.

Quote For Medical Debt Relief in Redland

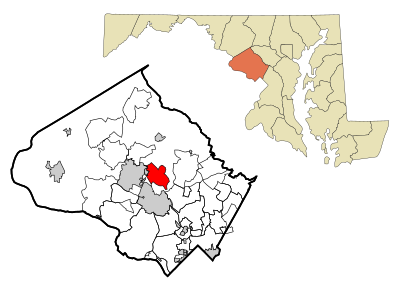

Redland Map

Redland Information

What Our Clients And Partner Have To Say About Us

What Our Clients And Partner Have To Say About Us

What Our Clients And Partner Have To Say About Us

Areas We Serve For Medical Debt Relief in Maryland

- Aberdeen

- Accokeek

- Adelphi

- Annapolis

- Annapolis Neck

- Arbutus

- Arnold

- Aspen Hill

- Ballenger Creek

- Baltimore

- Bel Air

- Bel Air North

- Bel Air South

- Beltsville

- Bensville

- Bethesda

- Bladensburg

- Bowie

- Brandywine

- Brock Hall

- Brooklyn Park

- Brunswick

- Burtonsville

- California

- Calverton

- Cambridge

- Camp Springs

- Carney

- Catonsville

- Chesapeake Beach

- Chesapeake Ranch Estates

- Chevy Chase

- Chillum

- Clarksburg

- Clinton

- Cloverly

- Cockeysville

- Colesville

- College Park

- Columbia

- Crofton

- Cumberland

- Damascus

- Dundalk

- East Riverdale

- Easton

- Edgewood

- Eldersburg

- Elkridge

- Elkton

- Ellicott City

- Essex

- Fairland

- Ferndale

- Forestville

- Fort Meade

- Fort Washington

- Frederick

- Friendly

- Gaithersburg

- Germantown

- Glassmanor

- Glen Burnie

- Glenmont

- Glenn Dale

- Greenbelt

- Hagerstown

- Halfway

- Havre de Grace

- Hillcrest Heights

- Hyattsville

- Ilchester

- Jessup

- Joppatowne

- Kemp Mill

- Kettering

- La Plata

- Lake Arbor

- Lake Shore

- Landover

- Langley Park

- Lanham

- Largo

- Laurel

- Lexington Park

- Linthicum

- Lochearn

- Maryland City

- Mays Chapel

- Middle River

- Milford Mill

- Mitchellville

- Montgomery Village

- Mount Airy

- New Carrollton

- North Bethesda

- North Laurel

- North Potomac

- Ocean Pines

- Odenton

- Olney

- Overlea

- Owings Mills

- Oxon Hill

- Parkville

- Parole

- Pasadena

- Perry Hall

- Pikesville

- Potomac

- Princess Anne

- Randallstown

- Redland

- Reisterstown

- Riviera Beach

- Rockville

- Rosaryville

- Rosedale

- Salisbury

- Scaggsville

- Seabrook

- Severn

- Severna Park

- Silver Spring

- South Laurel

- Suitland

- Summerfield

- Takoma Park

- Timonium

- Towson

- Travilah

- Urbana

- Waldorf

- Walker Mill

- Westminster

- Westphalia

- Wheaton

- White Oak

- Woodlawn